Free Tax Attorneys Invoice Template

Income Tax Preparation Invoices

Income Tax Preparation involves meticulous attention to detail and comprehensive understanding of tax laws. It requires accuracy in filing returns, supporting audits, and planning for future taxes. Professionals provide tailored advice on deductions and estimated taxes, ensuring compliance while optimizing financial outcomes. This work demands analytical skills, confidentiality, and the ability to navigate complex regulations effectively.

Tax Planning Invoices

Tax Planning involves strategic measures to minimize tax liabilities for individuals and businesses. It includes services like initial consultations, developing personalized tax strategies, assisting in document preparation, conducting thorough research on tax codes, holding quarterly review meetings, and providing final tax filing assistance.

Audit Representation Invoices

Audit Representation involves expert guidance during IRS or state tax audits. It includes reviewing financial statements, assessing internal controls, ensuring compliance, analyzing risks, investigating fraud, and preparing detailed reports. This service ensures accurate representation of a client's financial position to meet regulatory requirements effectively.

Tax Dispute Resolution Invoices

Tax Dispute Resolution involves negotiating and resolving conflicts between clients and tax agencies over assessments or penalties. It requires thorough document review, strategic correspondence with authorities, representation at hearings, and preparation of legal documents. The process includes an initial consultation to understand the case, followed by post-resolution follow-up to ensure compliance and closure.

Estate Planning Invoices

Estate planning involves strategic preparation to manage and transfer assets efficiently, minimizing estate taxes. Key tasks include drafting wills, establishing trusts, setting up powers of attorney, preparing living wills, planning for estate taxes, and reviewing beneficiary designations. This work ensures that an individual's financial legacy is secured according to their wishes while optimizing tax implications.

Business Tax Compliance Invoices

Business Tax Compliance involves ensuring adherence to tax laws at federal, state, and local levels. It includes preparing tax filings, managing quarterly submissions, consulting on tax code updates, providing audit support, analyzing deductions, and reviewing state compliance. This work requires meticulous attention to detail, up-to-date legal knowledge, and strategic planning to optimize tax obligations while maintaining regulatory adherence.

Tax Deduction Optimization Invoices

Tax Deduction Optimization involves analyzing tax codes to identify eligible deductions, thereby reducing taxable income. It includes services like deduction identification, planning workshops, documentation assistance, and consultations for quarterly reviews and final audits. The goal is to maximize savings through strategic tax planning and preparation.

International Taxation Invoices

International taxation involves advising on tax obligations for entities engaged in cross-border activities. Key characteristics include consultation on tax treaties, transfer pricing studies, and compliance audits. It also encompasses double taxation relief planning, M&A tax advisory, and foreign tax credit analysis to optimize global tax strategies and ensure adherence to international regulations.

Tax Fraud Defense Invoices

Tax Fraud Defense involves safeguarding clients against accusations of tax fraud or evasion. This specialized service includes an initial consultation to understand the case, thorough document analysis, comprehensive legal research, and preparation for court representation. It also covers negotiation with tax authorities and follow-up assistance to ensure compliance, aiming to protect client rights and achieve favorable outcomes.

Corporate Tax Structuring Invoices

Corporate Tax Structuring involves advising on optimizing tax efficiency for corporations. Key activities include reviewing tax compliance, analyzing entity restructuring, developing transfer pricing strategies, consulting on tax treaty utilization, planning risk mitigation, and preparing necessary documentation to ensure legal adherence and strategic financial benefits.

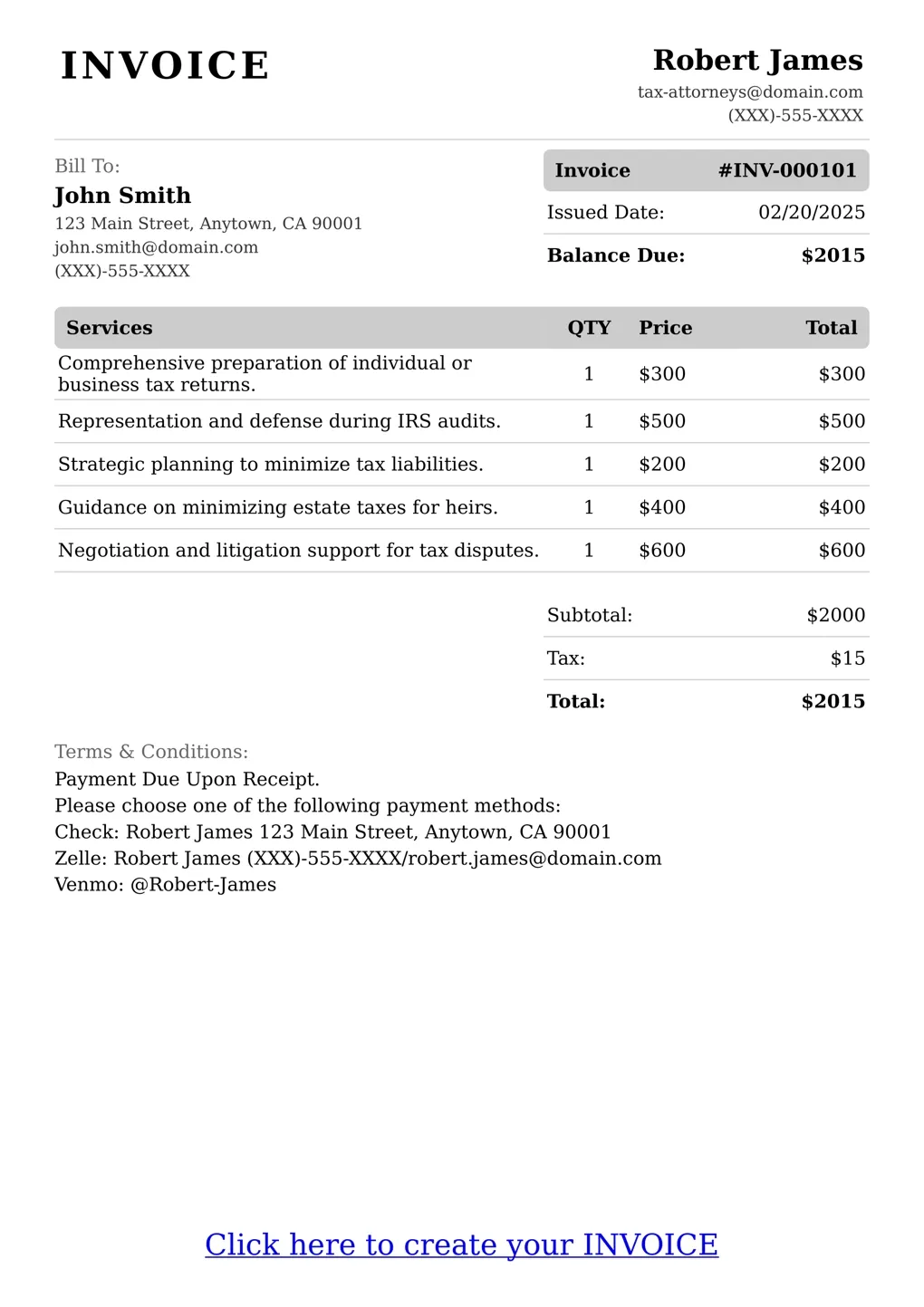

An invoice is a commercial document issued by a seller to record the transaction and show the amount of goods or services received by the buyer. In relation to tax attorneys, an invoice is an essential document that plays a crucial role in their business operations. Tax attorneys use invoices as a primary means to demonstrate the income earned from clients for which they are responsible for providing tax advice.

FAQ

What does the online invoice creation platform cost?

It is free of charge.

Can I print or download my invoice as PDF for free?

Yes, you can.

Is there any additional fee for large quantity invoices?

No, there is no additional fee.

How long does it take to create an invoice?

You can create and download your invoice instantly.

Can I use this platform for international clients?

Yes, the platform supports multiple countries and currencies.

Is my information secure on the online platform?

Yes, our platform uses industry-standard security measures to protect your data.

How do I access my invoices after they have been created?

You can download or print them directly from the platform.

Can I use this platform for personal projects or business expenses?

Yes, it is suitable for both personal and business purposes.